The financial services sector is the most important sector of the modern economy. The financial services sector provides opportunities for households to choose the best combination of investments in terms of return on investment, duration and security. It also provides opportunities for businesses and governments to fund their activities by raising surplus funds.

The concept of Islamic finance can be traced back to about 1400 years, but its recent history can be tracked back to the 1970s, when Islamic banks were founded in Saudi Arabia and the United Arab Emirates. Islamic finance, as it is in its infancy, is a mere 2% of the total finance market of the world. It is a combination of traditional Islamic financial institutions and Shariah-compliant commercial financial institutions such as

- Islamic Banks and Takaful

- Islamic Capital Markets

- Islamic Microfinance Institution

- Zakat Institution

- Waqf Institution

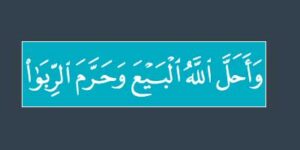

But why should a Muslim adapt to Islamic finance? The Verse below answers that question:

“And Allah has permitted trade and forbidden Riba” [Al Baqara 275]

Conventional Finance which is prevalent in the world today is all based on riba. A firm, group or individual takes loan for business purposes from financial institutions and has to return the principal along with interest on it irrespective of the performance of the business venture. It is this delinking to business performance that has led the world into several financial crises.

According to (Carmen M. Reinhart and Kenneth S. Rogoff 2010) excessive debt is the root cause of many financial crises. A classic example is the subprime mortgage crises in 2007-2008 which crashed the entire financial system of the economic superpower, USA.

From these examples we learn, it is mandatory on the Muslims to develop Islamic finance as an alternative finance system providing Shariah complaint financial products. The application of Shariah law is not limited to Muslims except in the context of beliefs and rituals. In addition, Islamic property and financial issues are among the subjects that Islamic regulation serves the wellbeing of all humankind.

According to Shaykh Muhammad Taqi Usmani, in his paper, “Post-Crisis Reforms: Some Points to Ponder”, referring to the 2007-2008 financial crises that shook the world; a viable solution to counter this unfair system is to restructure the entire financial system and move away from the current debt-based – risk transfer system towards an equity-based- risk sharing system.

By: Sadaf Sawant (Senior Manager Shariah Advisory)

Usmani and Co. Shariah Advisors (Pvt) Ltd

Jamia Dar ul Uloom, Karachi.