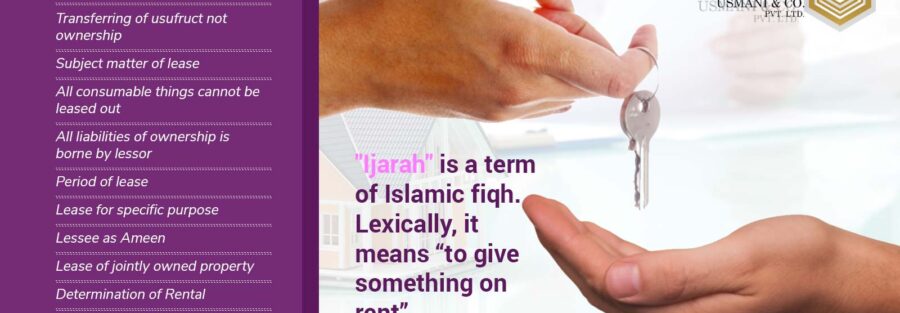

“Ijarah” is a term of Islamic fiqh. Lexically, it means “to give something on rent”. In Islamic jurisprudence, the term “Ijarah” is used for two different situations:

- In the first place, it means “to employ the services of a person on wages given to him as a consideration for his hired services.” The employer is called “Mustajir” while the employee is called “Ajir”, while the wages paid to the Ajir are called their “Ujrah”.

Example

If ‘A’ has employed ‘B’ in his office as a manager on a monthly salary, ‘A’ is the Mustajir, and ‘B’ is the Ajir. Similarly, if ‘A’ has hired the services of a porter to carry his baggage to the airport, ‘A’ is the Mustajir while the porter is an Ajir and in both cases, the transaction between the parties is termed as “Ijarah-tul- Ashkhas”.

- The second type of Ijarah relates to the usufructs of assets and not to the services of human beings. ‘Ijarah’ in this sense means “to transfer the usufruct of a particular property to another person in exchange for a rent claimed from him.” In this case, the term ‘Ijarah’ is analogous to the English term ‘leasing’. Here, the lessor is called ‘Mujir’, the lessee is called ‘Mustajir’ and the rent payable to the lessor is called ‘Ujrah’. However, there are many differences between leasing contract of Conventional Bank and Ijarah, which will be discussed in detail.

Basic Rules

The basic rules of Ijarah are as follows:

Transferring of usufruct not ownership

In leasing, the owner transfers its usufruct to another person for an agreed period, at an agreed consideration.

Subject matter of lease

The subject matter of lease should be valuable, identified and quantified.

All consumable things cannot be leased out

The corpus of the leased property remains in the ownership of the seller, and only its usufruct is transferred to the lessee. Thus, anything which cannot be used without consuming, cannot be leased out. For example, money, wheat etc.

All liabilities of ownership is borne by lessor

As the corpus of the leased property remains in the ownership of the lessor, so all the liabilities emerging from the ownership shall be borne by the lessor.

Period of lease

- The period of lease must be determined in clear terms.

- It is necessary for a valid lease that the leased asset is fully identified by the parties.

Lease for specific purpose

The lessee cannot use the leased asset for any purpose other than the one specified in the lease agreement. However, if no such purpose is specified in the agreement, the lessee can use it for whatever purpose it is used in the normal course.

Lessee as Ameen

- The lessee is liable to compensate the lessor for every damage to the leased asset caused by his misuse or negligence.

- The leased asset shall remain in the risk of the lessor throughout the lease period in the sense that any damage or loss caused by the factors beyond the control of the lessee shall be borne by the lessor.

Lease of jointly owned property

- A property jointly owned by two or more persons can be leased out and the rental shall be distributed between all joint owners according to the proportion of their respective shares in the property.

- A joint owner of a property can lease his proportionate share only to his co-sharer and not to any other person.

Determination of Rental

- The rental must be determined at the time of contract for the whole period of lease.

- It is permissible that different amounts of rent could by fixed for different phases during the lease period, provided the amount of rent for each phase is specifically agreed upon at the time of affecting the lease. If the rent for a subsequent phase of the lease period has not been determined or has been left at the option of the lessor, the lease is not valid.

- The determination of rental on the basis of the aggregate cost incurred in the purchase of the asset by the lessor, as normally done in financial leases, is not against the rules of Shariah if both parties agree to it, provided all other conditions of a valid lease prescribed by the Shariah are fully adhered to.

- The lessor cannot increase the rent unilaterally and any agreement to this effect is void.

- The rent or any part thereof may be payable in advance before the delivery of the asset to the lessee, but the amount so collected by the lessor shall remain with him as ‘on account’ payment and shall be adjusted towards the rent after its being due.

- The lease period shall commence from the date on which the leased asset has been delivered to the lessee.

- If the leased asset has totally lost the function for which it was leased, the contract will stand terminated.

- The rentals can be used on or benchmarked with some Index as well. In this case, the ceiling and floor rentals can be identified for validity of lease.

Lease as a mode of financing

Lease is not originally a mode of financing. It is simply a transaction meant to transfer the usufruct of an asset from one person to another for an agreed period against an agreed consideration. However, certain financial institutions have adopted leasing as a mode of financing instead of long-term lending on the basis of interest.

This transaction of financial lease may be used for Islamic financing, subject to certain conditions. It is not sufficient for this purpose to substitute the name ‘interest’ for ‘rent’ and replace the name ‘mortgage’ for ‘leased asset’. There must be a substantial difference between leasing and an interest-bearing loan. That will be possible

only by following all the Islamic rules of leasing, some of which have been mentioned earlier.

To be more specific, some basic differences between the contemporary financial leasing and the actual leasing allowed by the Shariah are indicated below:

| Sn. |

Conventional Leasing |

Ijarah |

|

1. |

The asset to be leased is not owned by the bank. |

The asset to be leased is owned by the bank. |

|

2. |

The bank is not responsible for any loss to the asset. |

The bank bears all the risk of loss of asset if such loss is not caused by the negligence of the customer. |

|

3. |

Rent is charged and demanded prior to delivery of the asset. |

No rent can be charged and demanded prior to the delivery of the asset. |

|

4. |

The conventional lease agreements give unilateral right to bank to terminate the Lease Agreement without any reason. |

Since Ijarah is a binding agreement therefore, neither party can terminate it without mutual consent unless if there is a breach of contract by either party. |

|

5. |

Penalty on late payment is charged. | Penalty on late payment cannot be charged. |

The commencement of lease

Unlike the contract of sale, the agreement of Ijarah can be effected for a future date. Hence, it is different from Murabaha. In most cases of the ‘financial lease’, the lessor i.e. the financial institution purchases the asset through the lessee himself. The lessee purchases the asset on behalf of the lessor who pays its price to the supplier, either directly or through the lessee.

In some lease agreements, the lease commences on the very day on which the price is paid by the lessor, irrespective of whether the lessee has effected payment to the supplier and taken delivery of the asset or not. It may mean that lessee’s liability for the rent starts before the lessee takes delivery of the asset. This is not allowed in Shariah, because it amounts to charging rent on the money given to the customer, which is nothing but interest, pure and simple.

Rent should be charged after the delivery of the leased asset

The correct way, according to Shariah, is that the rent will be charged after the lessee has taken the delivery of the asset, and not from the day the price has been paid. If the supplier has delayed the delivery after receiving the full price, the lessee should not be liable for the rent of the period of delay.

Relationship between contracting parties

It should be clearly understood that when the lessee himself has been entrusted with the purchase of the asset intended to be leased, there are two separate relations between the institution and the client, which come into operation one after the other. In the first instance, the client is an agent of the institution to purchase the asset on latter’s behalf. At this stage, the relation between the parties is nothing more than the relation of a principal and his agent. The relation of lessor and lessee has not yet come into operation.

The second stage begins from the date when the client takes delivery from the supplier. At this stage, the relation of lessor and lessee comes to play its role. These two capacities of the parties should not be mixed up or confused with each other. During the first stage, the client cannot be held liable for the obligations of a lessee. In this period, he is responsible to carry out the functions of an agent only. But when the asset is delivered to him, he is liable to discharge his obligations as a lessee.

Difference between Murabaha and leasing

In Murabaha, as mentioned earlier, the actual sale should take place after the client takes delivery from the supplier and the previous agreement of Murabaha is not enough for effecting the actual sale. Therefore, after taking possession of the asset as an agent, he is bound to give intimation to the institution and make an offer for the purchase from him. The sale takes place after the institution accepts the offer.

The procedure in leasing is different and a little shorter. Here, the parties need not affect the lease contract after taking delivery. If the institution, while appointing the client as its agent, has agreed to lease the asset with effect from the date of delivery, the lease will automatically start on that date without any additional procedure. There are two reasons for this difference between Murabahah and Leasing:

It is a necessary condition for a valid sale that it should be affected instantly. Thus, a sale attributed to a future date is invalid in Shariah. But leasing can be attributed to a future date. Therefore, the previous agreement is not sufficient in the case of Murabaha, while it is quite enough in the case of leasing.

The basic principle of Shariah is that one cannot claim a profit or a fee for a property the risk of which was never borne by him. Applying this principle to Murabaha, the seller cannot claim a profit over a property, which never remained under his risk for a moment. Therefore, if the previous agreement is held to be sufficient for affecting a sale between the client and the institution, the asset shall be transferred to the client simultaneously when he takes its possession, and the asset shall not come into the risk of the seller even for a moment.

That is why the simultaneous transfer is not possible in Murabaha, and there should be a fresh offer and acceptance after the delivery.

In leasing, however, the asset remains under the risk and ownership of the lessor throughout the leasing period, as the ownership has not been transferred. Therefore, if the lease period begins right from the time when the client has taken delivery, it does not violate the principle mentioned above.

Expenses consequent to ownership

As the lessor is the owner of the asset and he has purchased it from the supplier through his agent, he is liable to pay all the expenses incurred in the process of its purchase and its import to the country of the lessor, for example, expenses of freight and customs duty etc.

The lessor can, of course, include all these expenses in his cost and can take them into consideration while fixing the rentals, but as a matter of principle, he is liable to bear all these expenses as the owner of the asset. Any agreement to the contrary, as is found in the traditional financial leases, is not in conformity with Shariah.

Lessee as Ameen/Liability of the parties in case of loss to the asset As mentioned in the basic principles of leasing, the lessee is responsible for any loss caused to the asset by his misuse or negligence. He can also be made liable to the wear and tear, which normally occurs during its use. But he cannot be made liable to a loss caused by the factors beyond his control. The agreements of the traditional ‘financial lease’ generally do not differentiate between the two situations. In a lease based on the Islamic principles, both the situations should be dealt differently.

Variable Rentals in Long Term Leases

In the long-term lease agreements, it is mostly not in the benefit of the lessor to fix one amount of rent for the whole period of lease, because the market conditions change from time to time. In this case, the lessor has two options:

- He can contract lease with a condition that the rent shall be increased according to a specified proportion (e.g. 5%) after a specified period (like one year).

- He can contract lease for a shorter period after which the parties can renew the lease at new terms and by mutual consent with full liberty to each one of them to refuse the renewal, in which case, the lessee is bound to vacate the leased property and return it back to the lessor.

These two options are available to the lessor according to the classical rules of Islamic Fiqh. However, some contemporary scholars have allowed, in long-term leases, to tie up the rental amount with a variable benchmark, which is so well known and well defined that it does not leave room for any dispute. For example, it is permissible according to the scholars to provide in the lease contract that in case of any increase in the taxes imposed by the government on the lessor, the rent will be increased to the extent of same amount.

Similarly, it is allowed by the scholars that the annual increase in the rent be tied up with the rate of inflation. Therefore, if there is an increase of 5% in the rate of inflation, it will result in an increase of 5% in the rent as well.

Based on the same principle, some Islamic banks use the rate of interest as a benchmark to determine the rental amounts. They want to earn the same profit through leasing as is earned by the conventional banks through advancing loans based on interest. Therefore, they want to tie up the rentals with the rate of interest and instead of fixing a definite amount of rental, they calculate the cost of purchasing the lease assets and want to earn through rentals an amount equal to the rate of interest.

So, in this case, the agreement provides that the rental will be equal to the rate of interest or to the rate of interest plus something. Since the rate of interest is variable, it cannot be determined for the whole lease period. Therefore, these contracts use the interest rate of a particular country (like LIBOR) as a benchmark for determining the periodical increase in the rent. This arrangement has been criticized on the following two grounds:

A- The first objection raised against it is that, by subjecting the rental payments to the rate of interest, the transaction is rendered akin to an interest-based financing. This objection can be overcome by saying that (as fully discussed in the case of Murabaha), the rate of interest is used as a benchmark only. So far as other requirements of Shariah for a valid lease are properly fulfilled, the contract may use any benchmark for determining the amount of rental.

The basic difference between an interest-based financing and a valid lease does not lie in the amount to be paid to the financier or the lessor. The basic difference is that in the case of lease, the lessor assumes the full risk of the corpus of the leased asset. If the asset is destroyed during the lease period, the lessor will suffer the loss. Similarly, if the leased asset loses its usufruct without any misuse or negligence on the part of the lessee, the lessor cannot claim the rent, while in the case of an interest-based financing, the financier is entitled

to receive interest, even if the debtor did not at all benefit from the money borrowed. So far as this basic difference is maintained (i.e. the lessor assumes the risk of the leased asset), the transaction cannot be categorized as an interest- bearing transaction, even though the amount of rent claimed from the lessee is equal to the rate of interest.

It is thus clear that the use of the rate of interest merely as a benchmark does not render the contract invalid as an interest

– based transaction. It is, however, advisable at all times to avoid using interest even as a benchmark, so that an Islamic transaction is totally distinguished from an un-Islamic one, having no resemblance to interest whatsoever.

B- The second objection to this arrangement is that the variations of the rate of interest being unknown, the rental tied up with the rate of interest will imply ‘Jahalah’ and ‘Gharar’ which is not permissible in Shariah. It is one of the basic requirements of Shariah that the parties must know the consideration in every contract when they enter into it. The consideration in a transaction of lease is the rent charged from the lessee, and therefore it must be known to each party right at the beginning of the contract of lease. If we tie up the rental with the future rate of interest, which is unknown, the amount of rent will remain unknown as well. This is the Jahalah or Gharar, which renders the transaction invalid.

Responding to this objection, one may say that the Jahalah has been prohibited for two reasons:

- It may lead to dispute between the parties. This reason is not applicable here, because both parties have agreed with mutual consent upon a well-defined benchmark that will serve as a criterion for determining the rent, and whatever amount is determined, based on this benchmark, will be acceptable to both parties. Therefore, there is no question of any dispute between them.

- The second reason for the prohibition of Jahalah is that it renders the parties susceptible to an unforeseen loss. It is possible that the rate of interest, in a particular period, increases to an unexpected level in which case the lessee will suffer.

It is equally possible that the rate of interest zooms down to an unexpected level, in which case the lessor may suffer. To meet the risks involved in such possibilities, it is suggested by some contemporary scholars that the relation between rent and the rate of interest is subjected to a limit or ceiling. For example, it may be provided in the base contract that the rental amount after a given period, will be changed according to the change in the rate of interest, but it will in no case be higher than 15% or lower than 5% of the previous monthly rent. It will mean that if the increase in the rate of interest is more than 15%, the rent will be increased only up to 15%. Conversely, if the decrease in the rate of interest is more than 5%, the rent will not be decreased to more than 5%.

In our opinion, this is the moderate view, which takes care of all the aspects involved in the issue.

Penalty for Late Payment of Rent

In some agreements of financial leases, a penalty is imposed on the lessee in case he delays the payment of rent after the due date. This penalty, if meant to add to the income of the lessor, is not warranted by the Shariah. The reason is that the rent after it becomes due, is a debt payable by the lessee, and is subject to all the rules prescribed for a debt. A monetary charge from a debtor for his late payment is exactly the riba prohibited by the Holy Quran. Therefore, the lessor cannot charge an additional amount in case the lessee delays payment of the rent.

Penalty of late payment is given to charity

In order to avoid the adverse consequences, an alternative may be resorted to. The lessee may be asked to undertake that, if he fails to pay rent on its due date, he will pay certain amount to a charity. For this purpose, the financier/lessor may maintain a charity fund where such amounts may be credited and disbursed for charitable purposes, including advancing interest-free loans to the needy persons. The amount payable for charitable purposes by the lessee may vary according to the period of default and may be calculated at per annum basis. The agreement of the lease may contain the following clause for this purpose:

“The Lessee hereby undertakes that, if he fails to pay rent at its due date, he shall pay an amount calculated at a certain percentage (%) per annum to the charity Fund maintained by the Lessor which will be used by the Lessor exclusively for charitable purposes approved by the Shariah and under no circumstances form part of the income of the Lessor.”

This arrangement though does not compensate the lessor for his opportunity cost of the period of default, yet it may serve as a strong deterrent for the lessee to pay the rent promptly.

Termination of Lease

If the lessee contravenes any term of the agreement, the lessor has a right to terminate the lease contract unilaterally. However, if there is no contravention on the part of the lessee, the lease cannot be terminated without mutual consent. In some agreements of the ‘financial lease’, it has been noticed that the lessor has been given an unrestricted power to terminate the lease unilaterally whenever he wishes, according to his sole discretion. This is again contrary to the principles of Shariah. In some agreements of the ‘financial lease’, a condition has been found to the effect that in case of the termination of lease, even at the option of the lessor, the lessee shall pay the rent of the remaining lease period.

This condition is obviously against Shariah and the principles of equity and justice. The basic reason for inserting such conditions in the agreement of lease is that the main concept behind the agreement is to give an interest-bearing loan under the ostensible cover of lease. That is why every effort is made to avoid the logical consequences of the lease contract.

Naturally, such a condition cannot be acceptable to Shariah. The logical consequence of the termination of lease is that the lessor should take the asset back. The lessee should be asked to pay the rent as due up to the date of termination. If the termination has been effected due to the misuse or negligence on the part of the lessee, he can also be asked to compensate the lessor for the loss caused by such misuse or negligence. But he cannot be compelled to pay the rent of the remaining period.

Insurance of the leased assets

If the leased property is insured under the Islamic mode of Takaful, it should be at the expense of the lessor and not at the expense of the lessee, as is generally provided in the agreements of the current ‘financial leases’.

The residual value of the leased asset

Another important feature of the modern ‘financial lease’ is that after the expiry of the lease period, the corpus of the leased asset is normally transferred to the lessee. As the lessor already recovers his cost along with an additional profit thereon, which is normally equal to the amount of interest which could have been earned on a loan of that amount advanced for that period, the lessor has no further interest in the leased asset. On the other hand, the lessee wants to retain the asset after the expiry of the leased period.

For these reasons, the leased asset is generally transferred to the lessee at the end of the lease, either free of any charge or at a nominal token price. To ensure that the asset will be transferred to the lessee, sometimes the lease contract has an express clause to this effect. Sometimes this condition is not mentioned in the contract expressly; however, it is understood between the parties that the title of the asset will be passed on to the lessee at the end of the lease term. This condition, whether it is express or implied, is not in accordance with the principles of Shariah. It is a well-settled rule of Islamic jurisprudence that one transaction cannot be tied up with another transaction so as to make the former a pre-condition for the other. Here, the transfer of the asset at the end has been made a necessary condition for the transaction of lease that is not allowed in Shariah.

The original position in Shariah is that the asset shall be the sole property of the lessor, and after the expiry of the lease period, the lessor shall be at liberty to take the asset back, or to renew the lease or to lease it out to another party, or sell it to the lessee or to any other person. The lessee cannot force him to sell it to him at a nominal price, nor can such a condition be imposed on the lessor in the lease agreement. But after the lease period expires, and the lessor wants to give the asset to the lessee as a gift or to sell it to him, he can do so by his free will.

However, some contemporary scholars, keeping in view the needs of the Islamic financial institutions have come up with an alternative. They say that the agreement of Ijarah itself should not contain a condition of gift or sale at the end of the lease period. However, the lessor may enter into a unilateral promise to sell the leased asset to the lessee at the end of the lease period. This promise will be binding on the lessor only. The principle, according to them, is that a unilateral promise to enter into a contract at a future date is allowed whereby the promisor is bound to fulfill the promise, but the promisee is not bound to enter into that contract. It means that he has an option to purchase, which he may or may not exercise. However, if he wants to exercise his option to purchase, the promisor cannot refuse it because he is bound by his promise.

Therefore, these scholars suggest that the lessor, after entering into the lease agreement, can sign a separate unilateral promise whereby he undertakes that if the lessee has paid all the amounts of rentals and wants to purchase the asset at a specified mutually acceptable price, he will sell the leased asset to him for that price. Once the lessor signs this promise, he is bound to fulfill it and the lessee may exercise his option to purchase at the end of the period, if he has fully paid the amounts of rent according to the agreement of lease.

Leasing for permissible (Halal) or impermissible usage

It is a brief abstract of an article written by grand Mufti of Pakistan, “Mufti Muhammad Shafi” about leasing or selling a property/asset that could be used for Haram purposes. Its brief description is as follows:

- If a person sells or leases such property or goods that cannot be used but for Haram purpose, then its contract of sale or lease would be invalid and the seller or lessor would be sinner.

- If a person sells or leases such a property or goods that can be used in Halal or Haram both purposes, and the seller/lessor does not know the exact purpose of the buyer/lessee of purchase or getting on lease, then it would be Halal to sell or lease.

- If a person sells or leases such a property or goods that can be used in Halal or Haram both purposes and the seller/lessor knows that he would use it only for Haram purpose, then the contract of Sale/Lease would be valid, however, the buyer/lessee would commit a sin of Karaha (Karahat/disliking). It means that the seller or lessor should avoid to sell or lease them to that person.

Now a question arises that what kind of Karaha would be involved here, “Al Karaha Al Tahreemiyyah” or “Al Karaha Al Tanzihiyyah”? (The first one means it is so detested or disliked that it has been very near to Haram. And the second one means that it is not so disliked as the former one, but it is not preferable).

To answer this question, Islamic jurists opined that if a property that is being sold or leased can be used for the both Haram and Halal purposes, but their manufacturing or building is more suitable for Haram purpose, then it would be Makrooh Al Tahreemi to be sold and leased, otherwise, it would be “Makrookh Al Tanzeehi” (the second kind).

Based on these principles, if the property is built in such a manner that it would be more suitable to use it for theatre purposes, then it is not preferable to sell or lease them, otherwise, it would be an act of sin.

However, if any property can be used for the both purposes equally, and seller or lessor knows that the buyer or lessee would use it for Haram purpose, then its sale or lease would be valid, but not preferable. Therefore, the buildings or land should not be sold or leased to a party that uses it for haram purposes, in any above mentioned two scenarios.

Accounting Treatment of Ijarah

Following general guidelines must be followed while developing accounting treatment for Ijarah transactions:

- The asset that is given on lease, must be recorded in the balance sheet of the Bank.

- Ijara Income can not be recognized by the Bank before the execution of Ijarah Agreement with the customer.

- Ijarah income will be recognized over the term of Ijarah on Straight line basis.

- Costs, including depreciation, incurred in earning the ijarah (lease) income are recognized as an expense.